Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Would you like to create a personalized quote?

Jamie Bowman

Jamie Bowman Insurance Agy Inc

Office Hours

Address

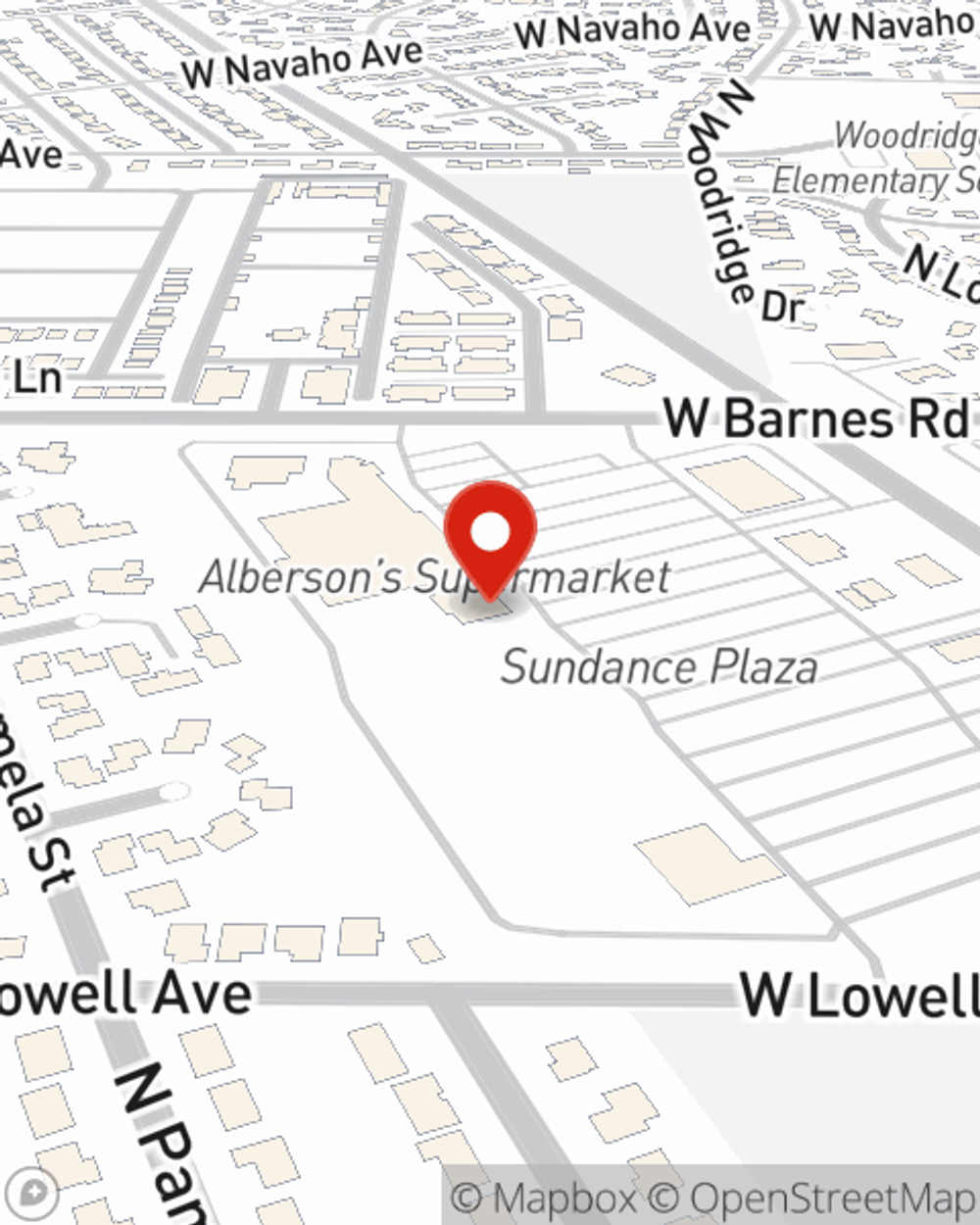

Spokane, WA 99208-9157

Just off of North Indian Trail Rd & W Barnes Rd in Sundance Plaza next to Safeway and Starbucks

Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

-

Phone

(509) 242-3520 -

Fax

(509) 703-7072

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Office Info

Office Info

Office Hours

-

Phone

(509) 242-3520 -

Fax

(509) 703-7072

Languages

Simple Insights®

The Real Consequences of Drunk Driving

The Real Consequences of Drunk Driving

What's at stake if you're caught drunk driving? A lot. These tips help you avoid the dangers of drinking and driving.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Social Media

Viewing team member 1 of 7

Kirsty Bowman

Office Manager

License #971713

I am a Washington native, originally from the Seattle area. I now live in the North Indian Trail neighborhood in North Spokane with my two kiddos and my husband, I also have two older girls that no longer live at home. I have worked in the restaurant industry for over 15 years and I recently transitioned into insurance. I understand that insurance can be complex and overwhelming, my passion is to help people understand how protect what is most important to them.

Viewing team member 2 of 7

Kirsten Whipple

Account Manager

License #1094842

Viewing team member 3 of 7

Ashley Mayer

Account Manager

License #1145868

Viewing team member 4 of 7

Shelby Cramer

Account Manager

License #1237676

Viewing team member 5 of 7

Madeleine Perkins

Account Manager

License #1249417

Viewing team member 6 of 7

Nic Baird

Account Manager

License #1287273

Viewing team member 7 of 7

Katie Neal

Account Manager

License #1233671

Airway Heights, WA Full Time